CLIENT:

SSA México, S.A. de C.V.

Our firm advises buyers and sellers, including Mexican and international private equity funds and strategic corporate players, in mergers and acquisitions involving publicly traded and private companies in Mexico, as well as in the purchase and sale of cash-flow generating assets located in the country.

We have structured and implemented transactions with varying degrees of complexity, including public takeover bids, corporate reorganizations and leveraged buyouts, with respect to companies engaged in a wide range of activities (financial services, insurance, telecommunications, pharmaceutical, retail, transportation and others), as well as different types of assets located throughout Mexico, such as hotels, power plants and other infrastructure assets.

Our services include both the negotiation of transactional documentation such as purchase and subscription agreements, governance documents such as shareholders and control agreements and project documentation (including, depending on the type of project, engineering and construction agreements, operating and management agreements, distribution, licensing agreements and administrative services agreements).

Our M&A practice group works hand in hand with our antitrust, tax, environmental and social and regulatory teams. Projects may also involve energy and infrastructure or real estate expertise provided by members of those practice areas

SSA México, S.A. de C.V.

Environmental and Social Impact

Mergers and Acquisitions

October 2023

ND

None

Ainda, Energía & Infraestructura

Energy and Infrastructure Projects

Mergers and Acquisitions

August 2023

ND

Mijares Angoitia Cortés y Fuente, S.C. - Counsel to Hokchi (Seller).

Deutsche Bank

Banking and Finance

Mergers and Acquisitions

July 2023

ND

Cleary Gottlieb Steen & Hamilton LLP, advising DB Skadden, Arps, Slate, Meagher & Flom LLP, advising Citi Creel, García-Cuellar, Aiza y Enriquez, S.C., advising Citi White & Case, advising Citi

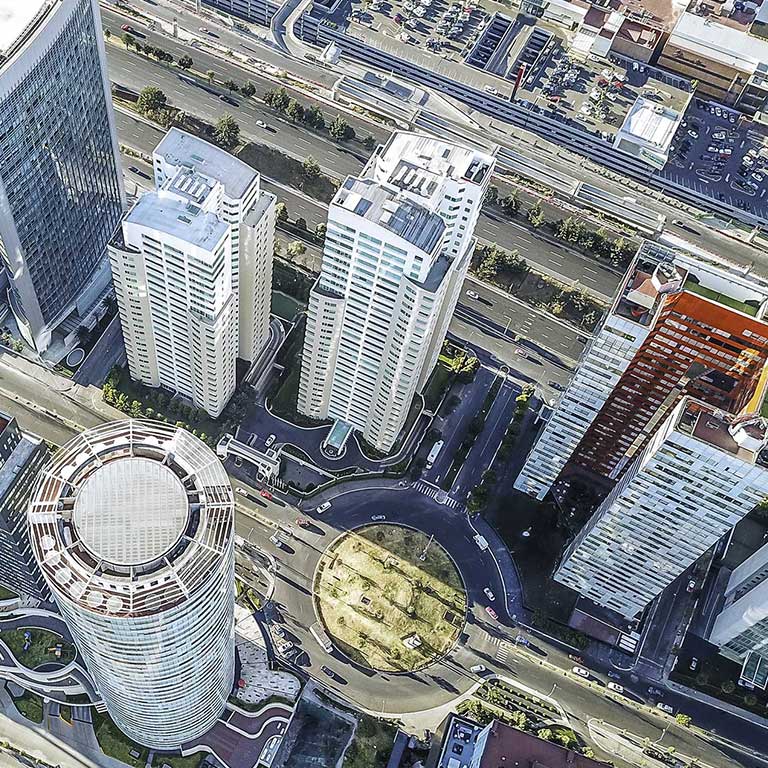

CIM Group

Mergers and Acquisitions

Real Estate

July 2023

MXN$1,530 millones

Nader Hayaux & Goebel - Counsel of purchaser ( Be Grand)

LatinFinance

Legal 500

Chambers Latam

Latin Lawyer

LatinFinance

Agora Report: M&A in the second quarter of 2023 - What has been the market performance in Mexico?

Mexican investor ups stake in Pan American Energy oil field

Citi acquires Deutsche Bank’s Mexican licence as it eyes IPO

VEI counsels Regcheq on USD$2 million investment round

DMI Decididas Summit 2023

REDD Intelligence - Latin America High Yield & Distressed Fall Summit

Webinar - Capital Raising 101

Latin Finance - The 14th Cumbre Financiera Mexicana

We make use of first party and third party cookies to improve your experience and our services by analyzing traffic in our website. If you continue browsing, then we shall consider that you are in agreement with our cookie policy